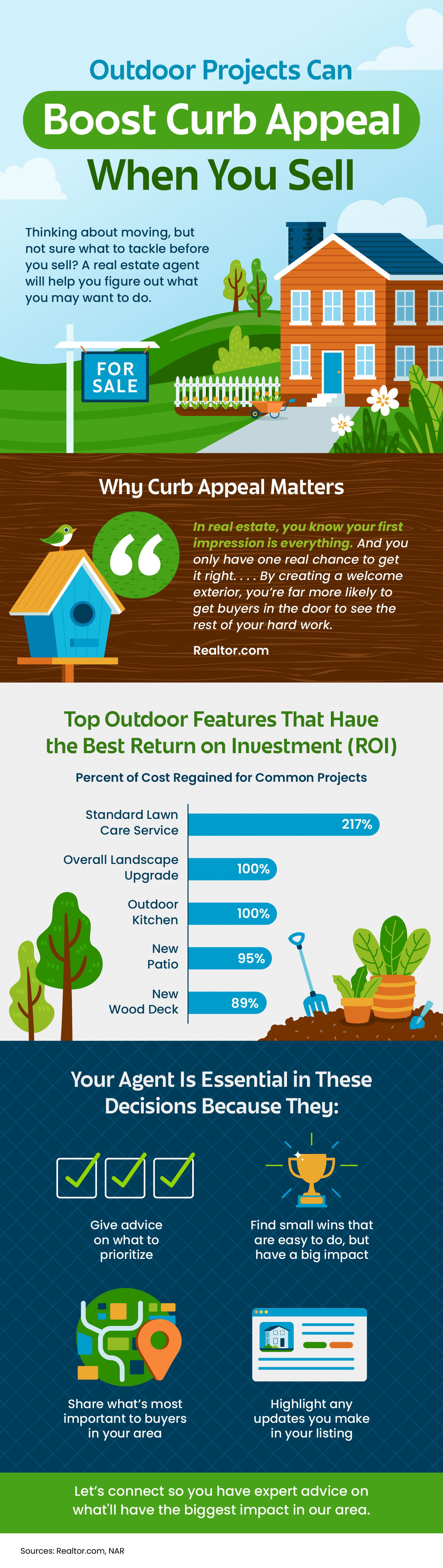

Outdoor Projects Can Boost Curb Appeal When You Sell

Some Highlights

- In real estate, a good first impression is key. If the outside of a house looks welcoming, more people will want to come in and see it.

- Your agent helps you by giving advice on what you may want to prioritize, finding easy fixes that make a big difference, knowing what buyers in your area like, and showing off your updates in your listing.

- Let’s connect so you have expert advice on what’ll have the biggest impact in our area.

3 Helpful Tips for First-Time Homebuyers

Some Highlights

- Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help.

- Look into homebuyer programs, expand your search area, and consider a multi-generational home.

- Let’s connect so you have an expert on your side to help you make your dream a reality.

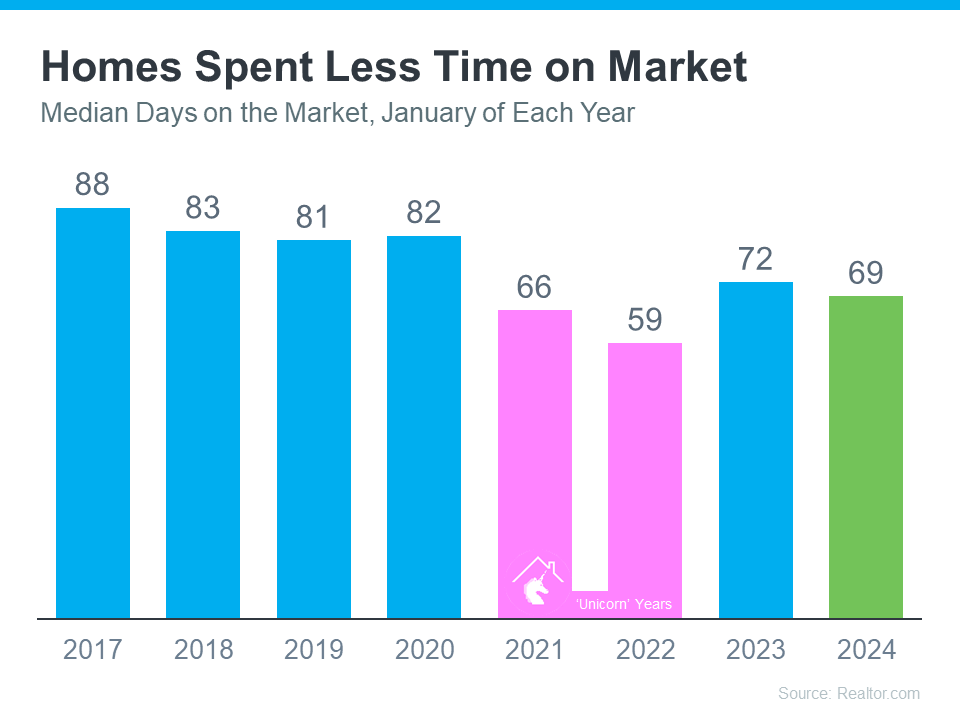

Houses Are Still Selling Fast

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than normal.

The graph below uses data from Realtor.com to tell the story of median days on the market for every January from 2017 all the way through the latest numbers available. For Realtor.com, days on the market means from the time a house is listed for sale until its closing date or the date it’s taken off the market. This metric can help give you an idea of just how quickly homes are selling compared to more normal years:

When you look at the most recent data (shown in green), it’s clear homes are selling faster than they usually would (shown in blue). In fact, the only years when houses sold even faster than they are right now were the abnormal ‘unicorn’ years (shown in pink). According to Realtor.com:

“Homes spent 69 days on the market, which is three days shorter than last year and more than two weeks shorter than before the COVID-19 pandemic.”

What Does This Mean for You?

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. That’s because more people are looking to buy now that mortgage rates have come down, but there still aren’t enough homes to go around. Mike Simonsen, Founder of Altos Research, says:

“. . . 2024 is starting stronger than last year. And demand is increasing each week.”

Bottom Line

If you’re wondering if it’s a good time to sell your home, the most recent data suggests it is. The housing market appears to be stronger than it usually is at this time of year. To get the latest updates on what’s happening in our local market, let’s connect.

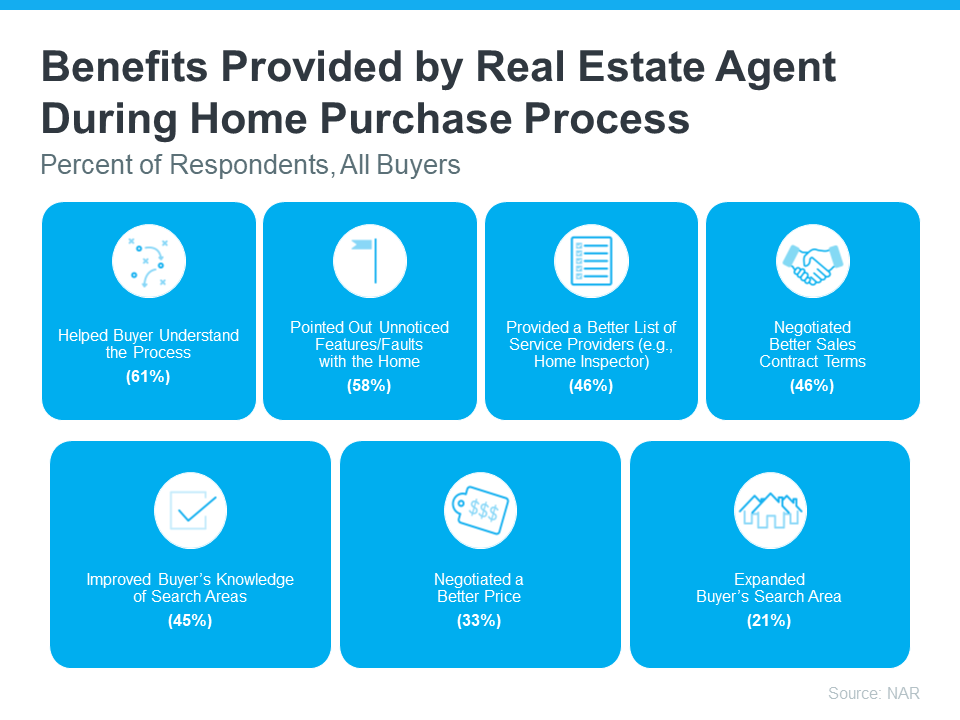

Why You Should Use a Real Estate Agent When You Buy a Home

If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t have to navigate all of that alone.

When it comes to buying a home, there are a lot of moving pieces. And that’s especially true in today’s housing market. The number of homes for sale is still low, and home prices and mortgage rates are still high. That combination can be tricky if you don’t have reliable expertise and a trusted advisor on your side. That’s why the best place to start is connecting with a local real estate agent.

Agents Are the #1 Most Useful Source in the Buying Process

The latest annual report from the National Association of Realtors (NAR) finds recent homebuyers agree the #1 most useful source of information they had in the home buying process was a real estate agent. Let’s break down why.

How an Agent Helps When You Buy a Home

When you think about a real estate agent, you may think of someone taking you on home showings and putting together the paperwork, but a great agent does so much more than that. It’s not just being the facilitator for your purchase, it’s being your guide through every step.

The visual below shows some examples from that same NAR release of the many ways an agent adds value. It includes the percentage of homebuyers in that report who highlighted each of these benefits:

Here’s a bit more context on how the survey results noted an agent continually helps buyers in these situations:

- Helped Buyer’s Understand the Process: Do you know the difference between an inspection and an appraisal, what each report tells you, and why they’re both important? Or that there are things you shouldn’t do after applying for a mortgage, like buying appliances or furniture? An agent knows all of these best practices and will share them with you along the way, so you don’t miss any key steps by the time you get to the closing table.

- Pointed Out Unnoticed Features or Faults with the Home: An agent also has a lot of experience evaluating homes. They’ve truly seen it all. They’ll be able to pinpoint some things you may not have noticed about the home that could help inform your decision or at least what repairs you ask for.

- Provided a Better List of Service Providers: In a real estate transaction, there are a lot of people involved. An agent has experience working with various professionals in your area, like home inspectors, and can help connect you with the pros you need for a successful experience.

- Negotiated Better Contract Terms and Price: Did something pop up in the home inspection or with the appraisal? An agent will help you re-negotiate as needed to get the best terms and price possible for you, so you feel confident with your big purchase.

- Improved Buyer’s Knowledge of the Search Area: Moving to a new town and you’re not familiar with the area, or you’re staying nearby, but don’t know which neighborhoods are most affordable? Either way, an agent knows the local area like the back of their hand and can help you find the perfect location for your needs.

- Expanded Buyer’s Search Area: And if you’re not finding anything you’re interested in within your initial search radius, an agent will know other neighborhoods nearby you should consider based on what you like, what amenities you want, and more.

Bottom Line

If you’re looking to buy a home, don’t forget about the many ways an agent is essential to that process. Any hurdle that pops up, a negotiation that needs to take place, and more, your agent will know how to handle it while they make sure to minimize your stress along the way. Let’s connect to tackle this together.

Sell Smarter: Why Working with a Real Estate Agent May Beat Going Solo

If you’re thinking about selling your house on your own, called “For Sale by Owner” or FSBO, there are some important things to consider. Going this route means taking on a lot of responsibilities by yourself – and that can be a bit of a headache.

A recent report from the National Association of Realtors (NAR) found two of the most difficult tasks for people who sell their house on their own are getting the price right and understanding and performing paperwork.

Here are just a few of the ways an agent helps with those difficult tasks.

Getting the Price Right

Setting the right price for your house is important when you’re trying to sell it. If you’re selling your house on your own, two common issues can happen. For starters, you might ask for too much money (overpricing). Alternatively, you might not ask for enough (underpricing). Either can make it hard to sell your house. According to NerdWallet:

“When selling a home, first impressions matter. Your house’s market debut is your first chance to attract a buyer and it’s important to get the pricing right. If your home is overpriced, you run the risk of buyers not seeing the listing.

. . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

To avoid these problems, it’s a good idea to team up with a real estate agent. Real estate agents know how to figure out the perfect price because they understand the local housing market. They can use their expertise to set a price that matches what buyers are willing to pay, giving your house the best chance to impress from the start.

Understanding and Performing Paperwork

Selling a house involves a bunch of paperwork and legal documentation that has to be just right. There are a lot of rules and regulations to follow, making it a bit tricky for homeowners to manage everything on their own. Without a pro by your side, you could end up facing liability risks and legal complications.

Real estate agents are experts in all the contracts and paperwork needed for selling a house. They know the rules and can guide you through it all, reducing the chance of mistakes that might lead to legal problems or delays.

So, instead of dealing with the growing pile of documents on your own, team up with an agent who can be your advisor, helping you avoid any legal bumps in the road.

Bottom Line

Selling your house is a big deal, and it can be complicated. Having a real estate agent can make a huge difference with setting the right price and managing all the details, so you can sell confidently. Let’s connect to make the process smooth and take the stress off your plate.

VA Loans Help Heroes Achieve Homeownership

Some Highlights

- VA home loans can help people who served our country become homeowners.

- These loans can help qualified individuals purchase a VA-approved home or condo, build a new home, or enhance their current one.

- Owning a home is the American Dream, and one way to show our appreciation to veterans is by providing them with important information about the advantages of VA home loans.

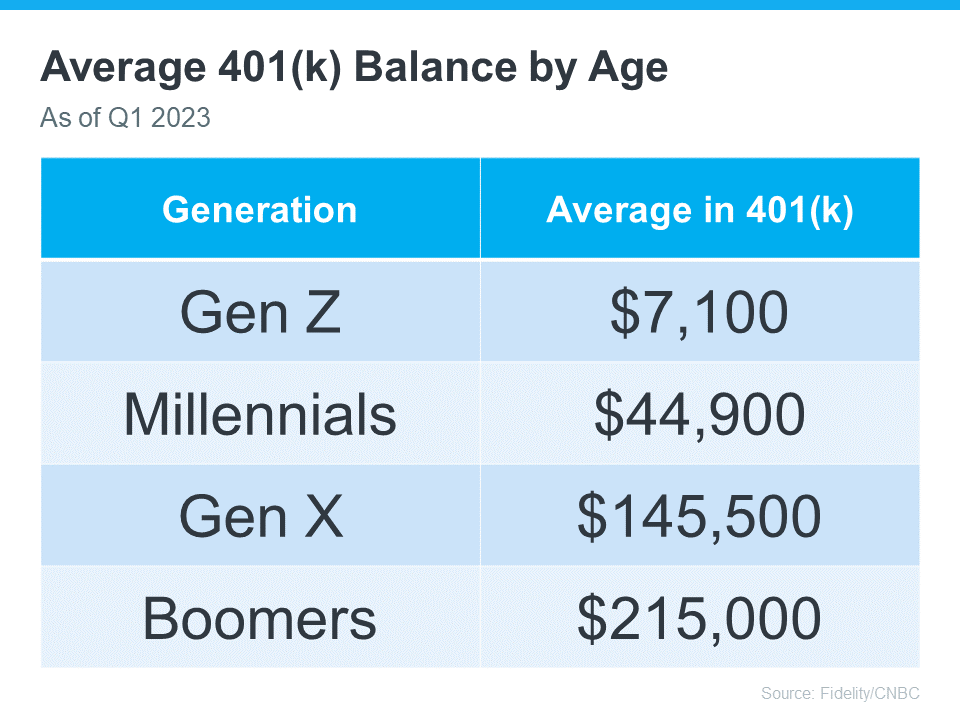

Thinking About Using Your 401(k) To Buy a Home?

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

What Are Accessory Dwelling Units and How Can They Benefit You?

Maybe you’re in the market for a home and are having a hard time finding the right one that fits your budget. Or perhaps you’re already a homeowner in need of extra income or a place for loved ones. Whether as a potential homebuyer or a homeowner with changing needs, accessory dwelling units, or ADUs for short, may be able to help you reach your goals.

What Is an ADU?

As AARP says:

“An ADU is a small residence that shares a single-family lot with a larger, primary dwelling.”

“An ADU is an independent, self-contained living space with a kitchen or kitchenette, bathroom and sleeping area.”

“An ADU can be located within, attached to, or detached from the main residence. It can be created out of an existing structure (such as a garage) or built anew.”

If you’re thinking about whether an ADU makes sense for you as a buyer or a homeowner, here’s some useful information and benefits that ADUs can provide. Keep in mind, that regulations for ADUs vary based on where you live, so lean on a local real estate professional for more information.

The Benefits of ADUs

Freddie Mac and the AARP identify some of the best features of ADUs for both buyers and homeowners:

- Living Close by, But Still Separate: ADUs allow loved ones to live together while having separate spaces. That means you can enjoy each other’s company and help each other out with things like childcare, but also have privacy when needed. If this appeals to you, you may want to consider buying a home with an ADU or adding an ADU onto your house. According to Freddie Mac:

“Having an accessory dwelling unit on an existing property has become a popular way for homeowners to offer independent living space to family members.”

- Aging in Place: Similarly, ADUs allow older people to be close to loved ones who can help them if they need it as they age. It gives them the best of both worlds – independence and support from loved ones. For example, if your parents are getting older and you want them nearby, you may want to buy a home with an ADU or build one onto your existing house.

- Affordable To Build: Since ADUs are often on the smaller side, they’re typically less expensive to build than larger, standalone homes. Building one can also increase your property’s value.

- Generating Additional Income: If you own a home with an ADU or if you build an ADU on your land, it can help generate rental income you could use toward your own mortgage payments. It’s worth noting that because an ADU exists on a single-family lot as a secondary dwelling, it typically cannot be sold separately from the primary residence. But that’s changing in some states. Work with a professional to understand your options.

These are a few of the reasons why many people who benefit from ADUs think they’re a good idea. As Scott Wild, SVP of Consulting at John Burns Research, says:

“It’s gone from a small niche in the market to really a much more impactful part of new housing.”

Bottom Line

ADUs have some great advantages for buyers and homeowners alike. If you’re interested, reach out to a real estate professional who can help you understand local codes and regulations for this type of housing and what’s available in your market.

Why Home Prices Keep Going Up

If you’ve ever dreamed of buying your own place, or selling your current house to upgrade, you’re no stranger to the rollercoaster of emotions changing home prices can stir up. It’s a tale of financial goals, doubts, and a dash of anxiety that many have been through.

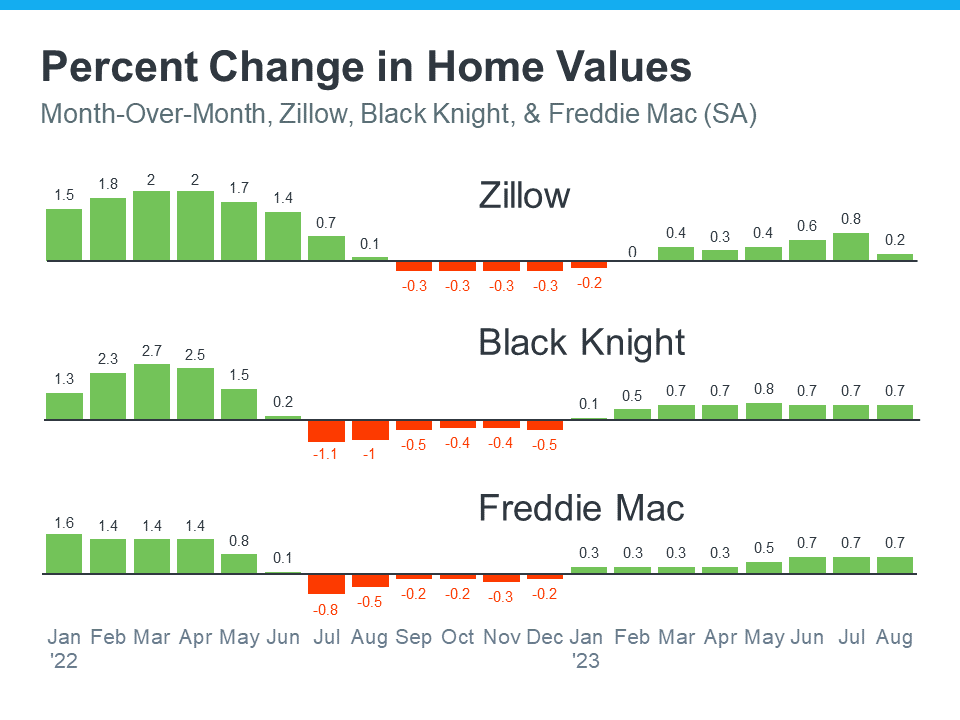

But if you put off moving because you’re worried home prices might drop, make no mistake, they’re not going down. In fact, it’s just the opposite. National data from several sources says they’ve been going up consistently this year (see graph below):

Here’s what this graph shows. In the first half of 2022, home prices rose significantly (the green bars on the left side of the graphs above). Those increases were dramatic and unsustainable.

So, in the second half of the year, prices went through a correction and started dipping a bit (shown in red). But those slight declines were shallow and short-lived. Still, the media really focused on those drops in their headlines – and that created a lot of fear and uncertainty among consumers.

But here’s what hasn’t been covered fully. So far in 2023, prices are going up once more, but this time at a more normal pace (the green bars on the right side of the graphs above). And after price gains that were too high and then the corrections that followed in 2022, the fact that all three reports show more normal or typical price appreciation this year is good news for the housing market.

Orphe Divounguy, Senior Economist at Zillow, explains changing home prices over the past 12 months this way:

“The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023. . . . That downturn has proven to be short lived as housing has rebounded impressively so far in 2023. . .”

Looking ahead, home price appreciation typically starts to ease up this time of year. As that happens, there’s some risk the media will confuse slowing price growth (deceleration of appreciation) with home prices falling (depreciation). Don’t be fooled. Slower price growth is still growth.

Why Are Home Prices Increasing Now?

One reason why home prices are going back up is because there still aren’t enough homes for sale for all the people who want to buy them.

Even though higher mortgage rates cause buyer demand to moderate, they also cause the supply of available homes to go down. That’s because of the mortgage rate lock-in effect. When rates rise, some homeowners are reluctant to sell and lose their current low mortgage rate just to take on a higher one for their next home.

So, with higher mortgage rates impacting both buyers and sellers, the supply and demand equation of the housing market has been affected. But since there are still more people who want to purchase homes than there are homes available to buy, prices continue to rise. As Freddie Mac states:

“While rising interest rates have reduced affordability—and therefore demand—they have also reduced supply through the mortgage rate lock-in effect. Overall, it appears the reduction in supply has outweighed the decrease in demand, thus house prices have started to increase . . .”

Here’s How This Impacts You

- Buyers: If you’ve been waiting to buy a home because you were afraid its value might drop, knowing that home prices have gone back up should make you feel better. Buying a home gives you a chance to own something that usually becomes more valuable over time.

- Sellers: If you’ve been holding off on selling your house because you were worried about how changing home prices would impact its value, it could be a smart move to work with a real estate agent and put your house on the market. You don’t have to wait any longer because the most recent data indicates home prices have turned in your favor.

Bottom Line

If you put off moving because you were worried that home prices might go down, data shows they’re increasing across the country. Let’s connect so you can understand how home prices are changing in our local area.

What Are the Real Reasons You Want To Move Right Now?

If you’re considering selling your house right now, it’s likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or just looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, let’s connect. That way, you’ll have someone to guide you through the process and help you find a home that works for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link